Key Components of the Imrat Group Futures

Sustainable Growth

Support for Sustainable Energy Projects

Investments in Green Energy

Investments in green energy are becoming increasingly attractive due to growing awareness of climate change and sustainable development. Many countries provide incentives, making such investments more profitable. Companies in the sustainable energy sector often show steady growth, attracting long-term investors. One successful example is NextEra Energy Partners, whose stock has risen over 300% since its IPO in 2014, reflecting the demand for clean energy solutions.

Digital Innovation

Backing Digital Solutions and Blockchain Startups

Shares of IG Venture Projects

Blockchain technology extends beyond cryptocurrencies, with uses in finance, logistics, data management, and even government systems. Its transparency and security drive significant investment in this area. A prominent example is Coinbase, which reached a valuation of over $85 billion after its IPO in 2021, demonstrating the high interest in blockchain technology and digital assets.

Medical Breakthroughs

Focus on Biotech and Medical Technologies

Investing in Healthcare

Innovative medical technologies, biotechnology, and pharmaceutical developments are critical today. The growing demand for new treatment methods and personalized medicine creates substantial growth opportunities. Moderna’s shares have surged over 400% since its IPO in 2018, driven by the development of the COVID-19 vaccine, showcasing the potential in biotechnology.

Ventures and IPOs

Easy Access to Venture and IPOs

For retail investors, raising the capital required to participate in venture capital and Pre-IPO and IPO projects is a significant challenge. However, with IG Future, Imrat Group investors have a unique opportunity to enter this dynamic industry.

Expert-Guided Investment Benefits

The key advantages of this cooperation are the company's many years of experience and deep understanding of the market, which allows retail investors to avoid spending time on detailed analysis of promising companies for investment. Participation in this segment creates opportunities for building a long-term and highly profitable investment portfolio, providing access to attractive investment solutions at early stages of development.

Risk Management in Venture and IPO Investments

It is important to note that investing in venture capital and Pre-IPO, IPO projects involves certain risks, including high volatility and uncertainty in the valuation of companies. To mitigate these risks and amortize invested funds, a portion of capital is allocated to maintain liquidity in both digital and established assets. This provides additional protection and stability to the portfolio while minimizing potential losses.This provides additional protection and stability to the portfolio while minimizing potential losses.

How to Start Investing?

To access venture capital investing, you must register or log in to your account and activate the option to contribute funds to the company's venture capital. As a result of these actions, you will receive an accumulated weekly return on your investment. This system allows you to participate in attractive investment projects and receive regular income based on accumulated funds.

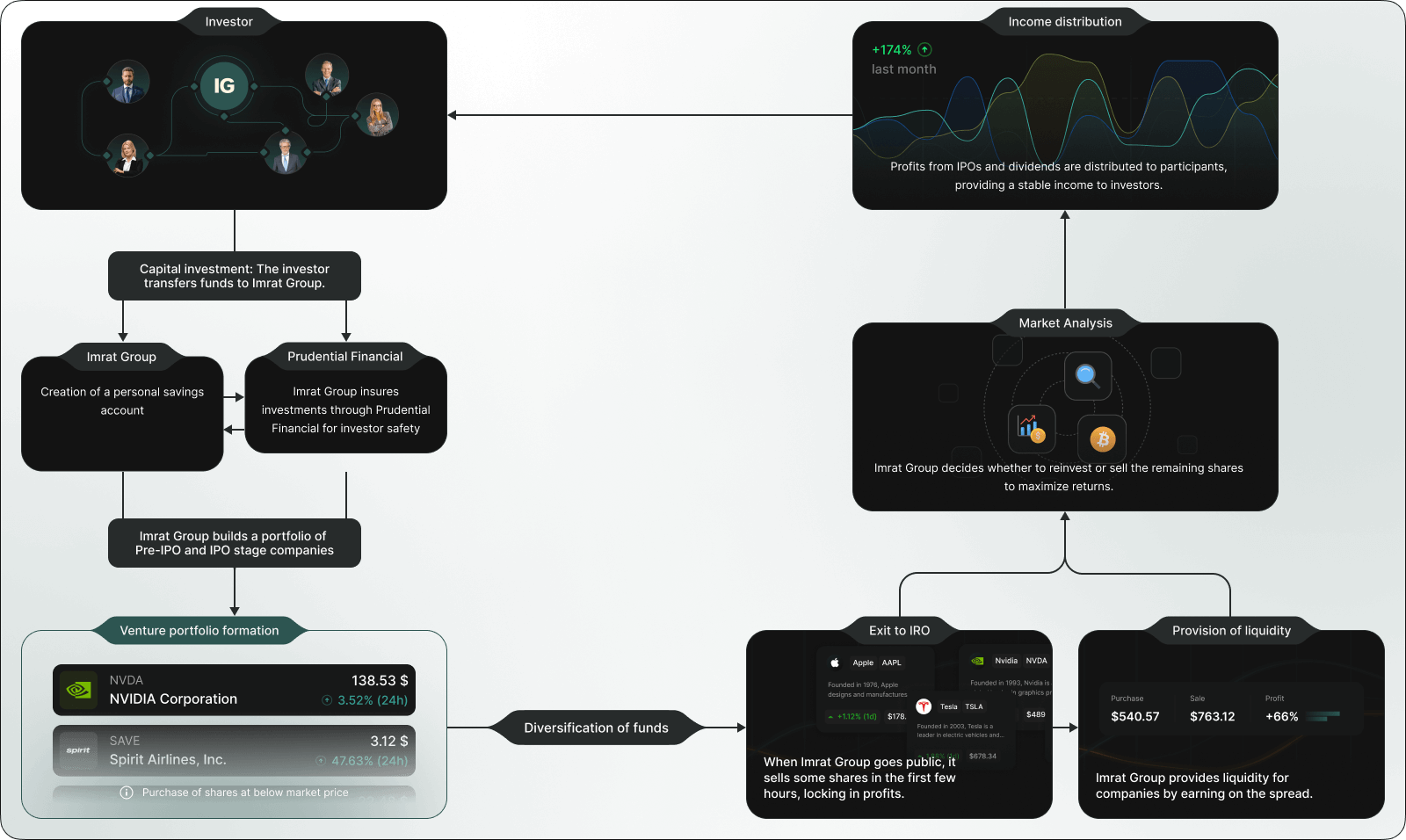

Imrat Group's investment process

The steps in the process allow Imrat Group to effectively manage investments and maximize returns for its clients through strategic steps at each stage.